2 2 Computing State Income Tax Answer Key

Taxation MCQs with answers. Samuels gross pay is 34000 a year.

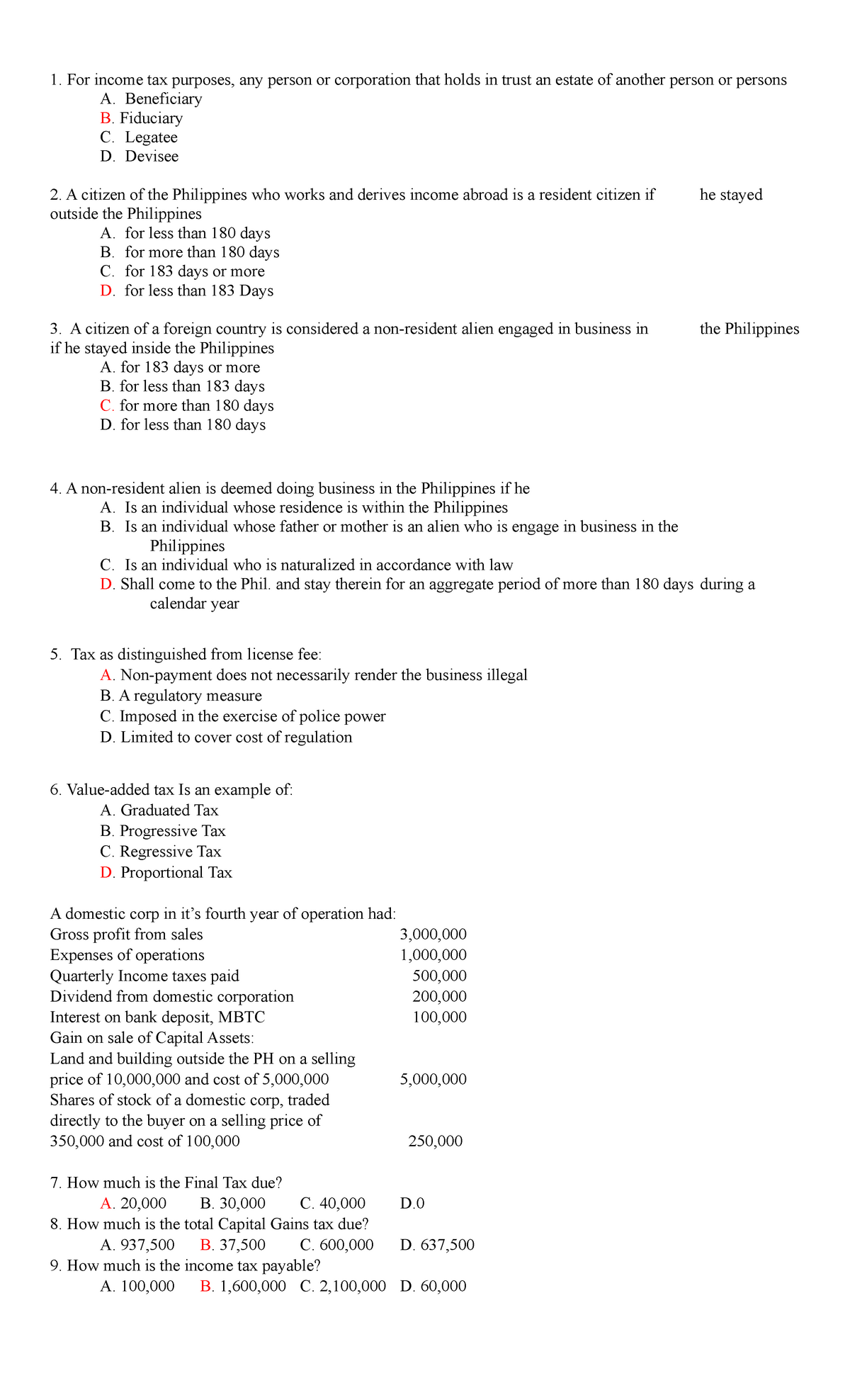

Midterm Exam Answers Income Taxation Tax 201 Studocu

Personal and dependency exemptions Taxable income Tax on taxable income Less.

. Wk8 Investment in Debt Securities Investment Property. Non-operating income 100000 Total Taxable Income P1000000 Less Exempt Threshold 250000 Net Taxable Income P 750000 Tax Due and Payable per table 30000 25750000-40000 P 117500 6. A tax where everyone pays the same percentage R.

Collectibles are taxed at 28. Exclusion from Gross Income CHAPTER 5 EXCLUSION FROM GROSS INCOME Problem 5 1 TAXABLE 1 Taxable. Use the table andor chart above to write a piecewise function to calculate actual Oregon income taxes owed for a given income.

Sarkariexam brings the information of INCOME TAX answer key 2014-2015. PERSONAL FINANCIAL LITERACY ANSWERS Lesson 21 Taxes. Operating expenses deductions 600000 Net operating Income P 900000 Add.

Section 2-5Calculate the deduction for group insurance. Section 2-3Determine the state taxes on a graduated income basis. Total pay before taxes and other deductions are taken out.

135 READ and do 1-17 ODD 23 SOLUTIONS PART 10 Lesson 24 Social Security and Medicare Taxes - Pg. Section 1231 gains are taxed at 25. 137 READ and do 1-21 ODD 24 SOLUTIONS PART 11 Lesson 25 Group Health Insurance - Pg.

Federal income tax P b. Tax credits Tax due or refund. Quizzes 2 The tax liability for a single individual with a taxable income of 73593 is.

Saras gross pay is 18900 a year. Cost of sales 1000000 Gross Profit P1500000 Less. Section 2-4Work out the amount of income withheld for Social Security and Medicare taxes.

Graduated State Income Tax. Find the taxable wages and the annual tax withheld. Section 2-6Figure out net pay per pay period.

Not all states and localities have income taxes. Blue Corporation has a. B Gross sales receipts P2500000 Less.

The percentage at which taxes are paid on each dollar of income. 15 or less the capital gains tax rate is 0. Includes both personal and business or corporate income taxes.

Label the following tax scenarios as progressive or regressive. Income Taxation Tax INCOME T AXA TION. Somebody Has to Pay Review Answers 1.

Remember to refer to the Personal Exemptions table on page 119 1. Deductions for AGI Adjusted Gross Income Less. The amount of income that is used to calculate an individuals or.

396 the capital gains tax rate is 20. VALENCIA ROXAS SUGGESTED ANSWERS 22 Chapter 5. X Income in dollars Tx Federal income tax owed by a single taxpayer Step 6.

State income tax rate is 15 percent of taxable income. Capital gains tax rates. Income Taxation - Answer key 6th Edition by Valencia- Chapter 5 1.

SOL UTION MANU AL REX BANGGA W AN 2017 EDITION. INCOME TAXATION 6TH Edition BY. Annual gross pay is 28000.

139 READ and do 1-9 ODD 13-23 ODD 25 SOLUTIONS PART 12. Federal state and local taxes on income both earned salaries wages tips commissions and unearned interest dividends. 15 but 396 the capital gains tax rate is 15.

This lesson is intended for my Consumer Math students learning how to calculate state income tax that is withheld from their paychecks. The state income tax rate is 4. If the income would ordinarily be taxed at.

He is married and claims 3 dependents. LA WS PRINCIPLE S AND APPLICA TIONS. Exclusions Gross Income Less.

Use your piecewise function to calculate how much John owes in. The greater of--Total itemized deductions or standard deduction Less. Tony Yamakoshis gross pay is 44750 a year.

INCOME TAX has just conducted exam all candidates will be curious and worried to know how they have performed in exams. A range of income amounts that are taxed at a particular rate. Sales tax R c.

Find the taxable wages and the annual taxes withheld. Personal Finance 101 Conversations video seriesW-4. Up to 24 cash back LESSON 21 22 23.

Handouts 21 22 and 23 one copy of each for each student Handout 23 Answer Key one copy for the teacher to use as a visual Optional. Intro TO TAX 1-1 - Lecture notes 1. Income tax to withhold.

Annual gross pay is 34300. The state income tax rate is 3. She is single and claims one dependent.

Federal and State Income Tax Flat Tax. Income broadly conceived Less. Lesson 23 Graduated State Income Tax - Pg.

Up to 24 cash back Section 2-2Compute the state taxes on a straight percent basis. Video Notes - You have to know the state income tax rate before you can calculate stuff - If you have a lot of dependents your tax rate goes down.

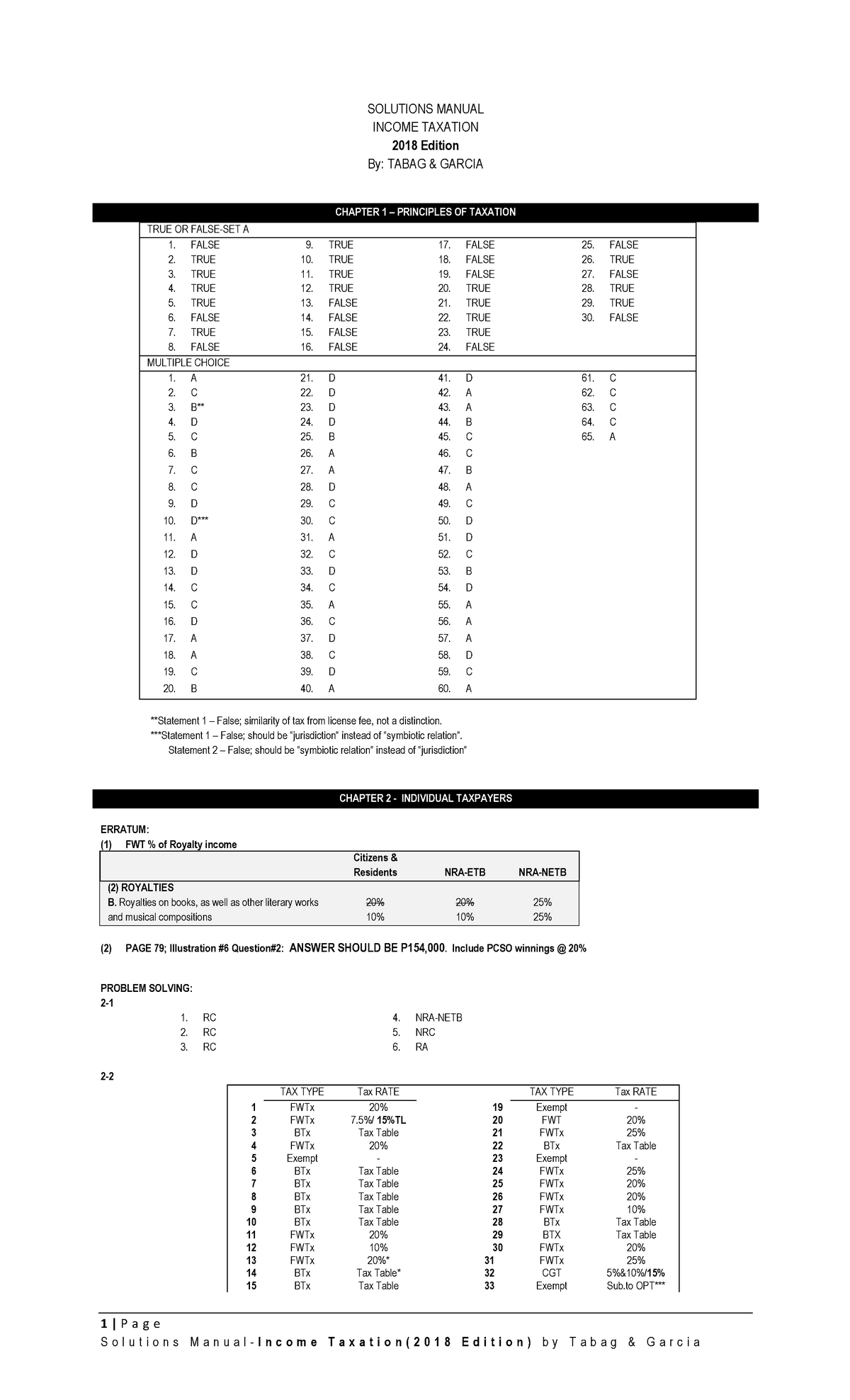

Income Taxation Tabag Garcia Auditing Theory Auditing Theory Studocu

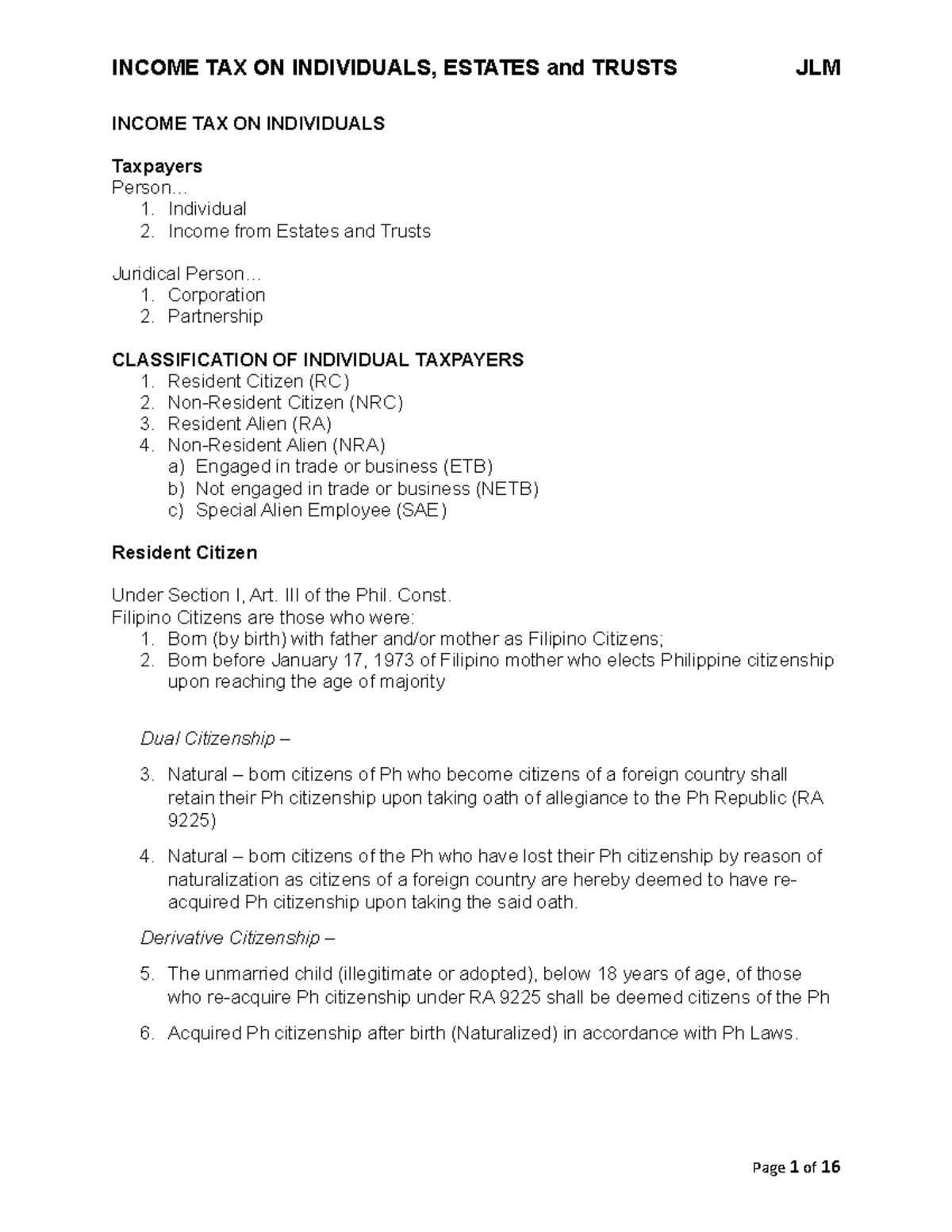

2 Income Tax On Individuals Income Tax On Individuals Taxpayers Person 1 Individual 2 Income Studocu

Pin On Personal Finance Investment

How To Calculate Income Tax In Excel

Profits And Gains From Business Or Profession Section 28 To 44d Commerce Notes Business Commerce Subject

Income Tax Cfa Level 1 At Level

Sahaj Gst Return New Gst Return Filing Form Masters India Receipt Maker Paying Taxes Tax Payment

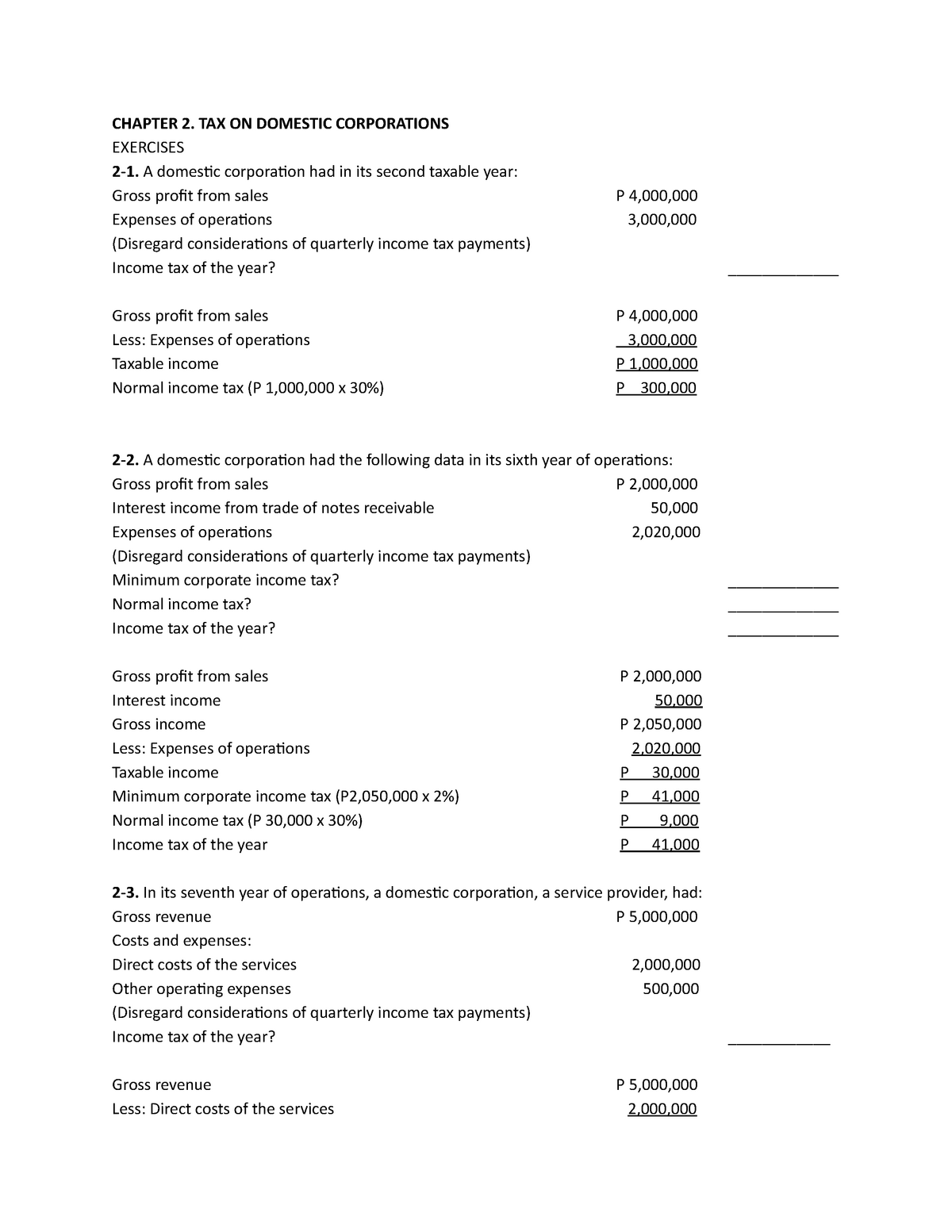

Tax 1 Day 1 Lesson Chapter 2 Tax On Domestic Corporations Exercises 2 1 A Domestic Corporation Studocu

3 11 3 Individual Income Tax Returns Internal Revenue Service

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Solved Inland Jewelers Solutionzip Solving Solutions Jewels

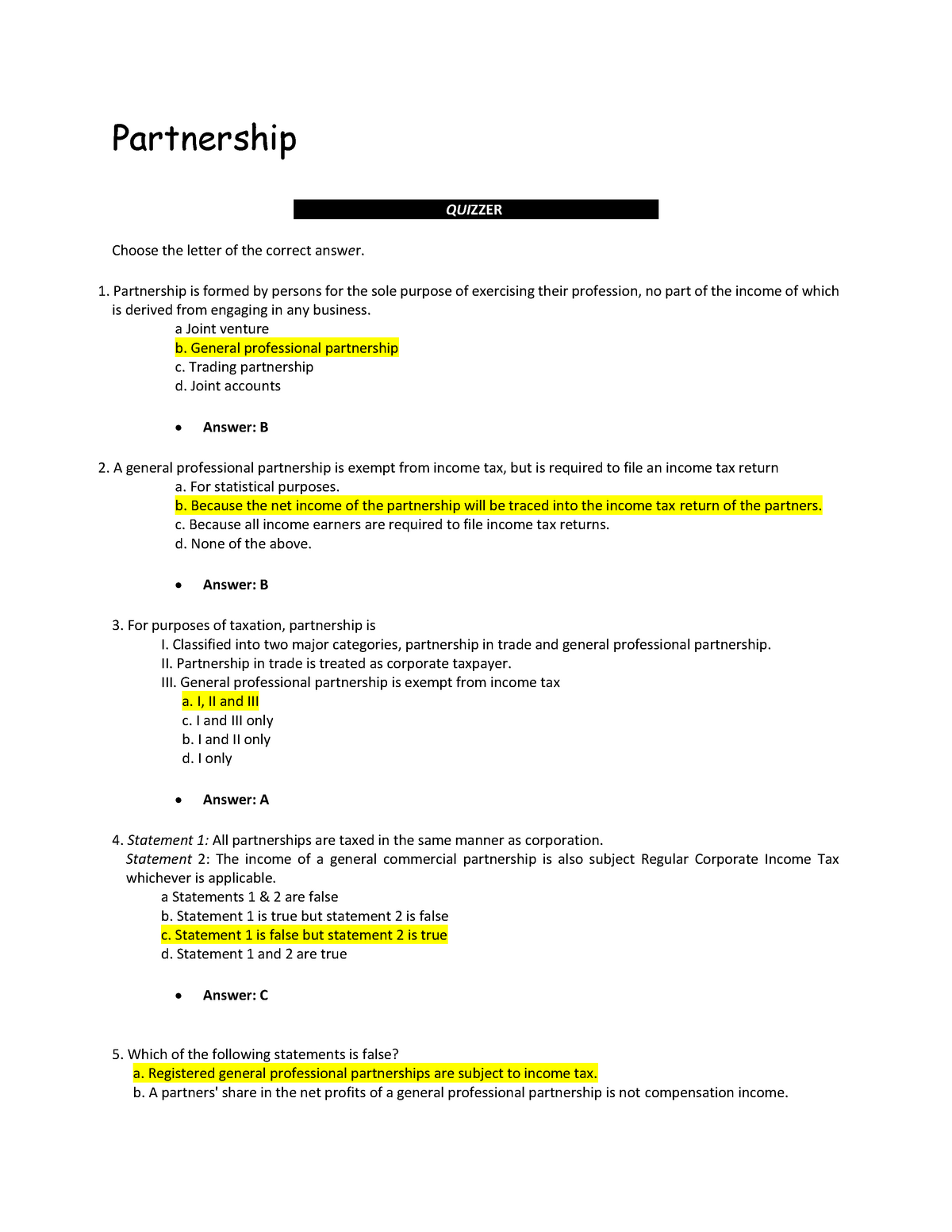

Taxation Mcqs With Answers Tax211 Ucc Studocu

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Comments

Post a Comment